The globe of electronic currencies continues to be rapidly evolving in the last few years, drawing both equally seasoned and new traders. This transformation is marked by large volatility, unprecedented development, and shifting Trader sentiment. Contemporary buyers at the moment are offered with a completely new landscape for diversifying their portfolios and attaining economic gains. Being familiar with the market tendencies and analyzing important elements is important for any individual navigating this elaborate nevertheless promising natural environment.

The Rise of Electronic Currencies

In the last 10 years, the electronic forex current market has developed from a distinct segment idea to a globally recognized asset course. At first found as being a fringe motion, digital currencies have captured the eye of not just personal traders but additionally institutional players. These belongings have delivered an alternative retail outlet of benefit and are actually found as a possible hedge in opposition to classic economic techniques. The evolution of digital property is underpinned by technological breakthroughs, regulatory clarity, and the common adoption of electronic fiscal options.

Crucial Industry Tendencies Shaping Electronic Asset Investing

one. Institutional Adoption

Among the most important developments from the digital asset space continues to be the entry of institutional investors. From main banking companies to hedge resources, Increasingly more huge fiscal establishments have begun to take a look at and invest in digital belongings. This craze has introduced increased legitimacy to the market and it has opened the doorway for even more innovations, such as economical products and solutions tied to digital currencies.

Institutional involvement usually includes bigger balance, as these entities have a tendency to have for a longer period financial commitment horizons and a lot more advanced possibility administration procedures. However, it also means that the industry might be motivated by significant gamers, making it vital for more compact traders to remain knowledgeable in regards to the pursuits of those establishments.

2. Technological Innovation and Infrastructure

Technological innovation plays a central part in shaping the future of the electronic asset current market. The introduction of blockchain, decentralized purposes, and good contracts has the potential to revolutionize various industries, such as finance, property, and provide chain management. As these systems evolve, they are going to possible drive the worth of electronic currencies increased, creating new prospects for investors.

Also, Increased infrastructure is which makes it simpler to entry and trade digital belongings. The start of person-welcoming investing platforms, the development of safe wallets, and enhancements in market place liquidity are all contributing to your growing attraction of digital assets for everyday buyers.

3. Elevated Regulation and Oversight

As electronic currencies have acquired level of popularity, regulators have started to determine frameworks to watch and Management the market. Governments all over the world are now working on making apparent and constant polices to make certain that digital property are used securely and transparently.

This rise in regulation is normally witnessed as a beneficial improvement, as it provides much more safety and legitimacy for traders. Additionally, it will help to safeguard the marketplace from fraudulent things to do, generating an atmosphere the place trusted assignments can thrive.

four. Current market Volatility

Current market volatility is amongst the defining attributes of electronic currencies. Important price tag fluctuations, normally because of external aspects like information events, marketplace sentiment, or federal government bulletins, can result in swift changes in worth. When volatility can present pitfalls, it also provides opportunities for traders to capitalize on price actions.

For modern investors, knowledge and managing danger is crucial. Diversifying portfolios, using possibility mitigation strategies, and staying educated about current market conditions can help mitigate the impacts of volatility and most likely convert sector fluctuations into profitable options.

Crucial Factors Impacting the Electronic Asset Current market

The market for electronic currencies is motivated by a wide range of components, from technological developments to macroeconomic trends. To raised recognize The existing sector dynamics, its necessary to contemplate these crucial factors.

1. Investor Sentiment and Media Coverage

Investor sentiment plays a vital purpose in the marketplaces price actions. When market participants are confident in the way forward for digital assets, they usually tend to invest in, driving up costs. Then again, panic or uncertainty may lead to provide-offs, causing prices to fall. Media protection, social media marketing developments, and influencer opinions can all have a significant impact on Trader sentiment and current market trends.

Its essential for buyers to recognize the power of sentiment-pushed volatility and stay away from creating expenditure decisions based solely on small-term emotions or headlines. A disciplined, prolonged-time period method is usually The obvious way to navigate the marketplace's ups and downs.

2. Technological Enhancements

As mentioned before, technologies is for the core in the digital asset revolution. The event of extra economical consensus mechanisms, Improved scalability remedies, and interoperability among distinct blockchain networks are all crucial elements that can influence the longer term value of digital belongings.

For example, enhancements in transaction velocity and Electrical power efficiency may well ethereum minimize expenses and improve the General charm of sure assets. Furthermore, the rise of decentralized finance (DeFi) platforms is transforming the way standard fiscal services are accessed, producing new financial commitment alternatives and increasing the use conditions for digital assets.

three. Macroeconomic Disorders

Like another economical asset, the value of electronic currencies is usually impacted by broader economic circumstances. One example is, world wide inflation fees, central bank insurance policies, and geopolitical instability can all affect the demand from customers for digital belongings. In instances of financial uncertainty, investors may possibly change to electronic currencies as a keep of benefit, bringing about a rise in rates. Conversely, periods of economic balance could possibly lead to less need, putting downward tension on rates.

International tendencies which include rising desire rates or modifications in fiscal policy may have profound results on electronic asset markets. Staying knowledgeable about worldwide financial disorders is A vital portion of making seem financial investment selections.

four. Provide and Demand from customers

The basic economic theory of source and need performs a crucial job in analyzing the cost of electronic currencies. A lot of electronic belongings are developed with a set source or restricted issuance, indicating that as demand from customers raises, the cost has a tendency to increase. This scarcity outcome could be significantly considerable in property with solid desire, such as These by using a significant volume of network adoption or robust use instances.

Nonetheless, its critical to recognize that desire for digital property may be affected by a variety of variables, which includes technological developments, regulatory modifications, and Trader sentiment. Keeping an eye on shifts in desire and comprehending the things that drive it may help buyers foresee value tendencies.

Summary: Making ready for the way forward for Electronic Asset Investing

Buying electronic property needs a deep comprehension of both the market traits as well as the underlying know-how that drives these property. As the marketplace matures and continues to create, new options and issues will emerge. By keeping informed about important traits, being familiar with the things that impression the market, and creating a audio expenditure technique, modern traders can posture on their own to navigate the complexities of the digital asset earth.

Though the road ahead may very well be unpredictable, the probable for lengthy-phrase expansion and innovation within the digital asset Room stays significant. By approaching this dynamic market with warning and self-confidence, investors can possibly comprehend considerable rewards, all whilst contributing to the next wave of monetary evolution.

Alana "Honey Boo Boo" Thompson Then & Now!

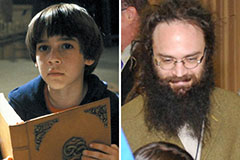

Alana "Honey Boo Boo" Thompson Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Kane Then & Now!

Kane Then & Now!